The Only Guide to Amur Capital Management Corporation

The Only Guide to Amur Capital Management Corporation

Blog Article

The Best Guide To Amur Capital Management Corporation

Table of ContentsAmur Capital Management Corporation Things To Know Before You BuyThe smart Trick of Amur Capital Management Corporation That Nobody is Talking AboutThe 10-Minute Rule for Amur Capital Management CorporationAmur Capital Management Corporation - QuestionsThe Facts About Amur Capital Management Corporation UncoveredAmur Capital Management Corporation Can Be Fun For AnyoneTop Guidelines Of Amur Capital Management Corporation

A reduced P/E ratio might show that a firm is undervalued, or that investors anticipate the firm to encounter more tough times in advance. What is the ideal P/E proportion? There's no best number. Financiers can utilize the ordinary P/E proportion of various other firms in the very same sector to form a baseline - alternative investment.

Some Known Details About Amur Capital Management Corporation

A stock's P/E proportion is easy to discover on many economic reporting websites. This number indicates the volatility of a supply in comparison to the market as a whole.

A stock with a beta of over 1 is theoretically more unstable than the marketplace. A safety with a beta of 1.3 is 30% even more volatile than the market. If the S&P 500 surges 5%, a supply with a beta of 1. https://www.bark.com/en/ca/company/amur-capital-management-corporation/kYQ8q/.3 can be anticipated to rise by 8%

Amur Capital Management Corporation Can Be Fun For Everyone

EPS is a buck figure standing for the section of a firm's incomes, after tax obligations and participating preferred stock rewards, that is alloted per share of ordinary shares. Capitalists can utilize this number to gauge just how well a firm can supply value to shareholders. A greater EPS begets greater share costs.

If a business on a regular basis fails to supply on incomes projections, an investor might intend to reassess buying the supply - alternative investment. The computation is simple. If a company has a take-home pay of $40 million and pays $4 million in dividends, after that the remaining sum of $36 million is divided by the variety of shares impressive

Little Known Questions About Amur Capital Management Corporation.

Financiers typically obtain curious about a supply after reviewing headings concerning its extraordinary efficiency. Simply bear in mind, that's the other day's information. Or, as the spending pamphlets constantly expression it, "Previous performance is not a predictor of future returns." Sound investing decisions ought to consider context. A take a look at the trend in prices over the previous 52 weeks at the least is required to get a feeling of where a supply's cost may go following.

Allow's check out what these terms imply, how they vary and which one is best for the average capitalist. Technical analysts brush through enormous volumes of data in an effort to anticipate the direction of stock prices. The information consists largely of previous pricing info and trading volume. Essential analysis fits the requirements of a lot of financiers and has the advantage of making great sense in the real globe.

They believe rates follow a pattern, and if they can figure out the pattern they can maximize it with well-timed professions. In recent years, innovation has actually enabled even more investors to exercise this style of spending because the tools and the information are much more accessible than ever before. Fundamental experts consider the inherent value of a stock.

Facts About Amur Capital Management Corporation Uncovered

Most of the concepts went over throughout this piece prevail in the basic expert's globe. Technical analysis is finest fit to someone who has the time and convenience degree with information to put infinite numbers to make use of. Or else, basic analysis will fit the needs of the majority of financiers, and it has the benefit of making good feeling in the real life.

Brokerage costs and shared fund cost ratios pull money from your profile. Those expenses cost you today and in the future. Over a period of 20 years, annual costs of 0.50% on a $100,000 investment will certainly decrease the profile's value by $10,000. Over the same period, a 1% cost will certainly decrease the same profile by $30,000.

The trend is with you. Numerous shared fund firms and online brokers are reducing their charges in order to compete for customers. Take benefit of the pattern and look around for the most affordable cost.

The Only Guide for Amur Capital Management Corporation

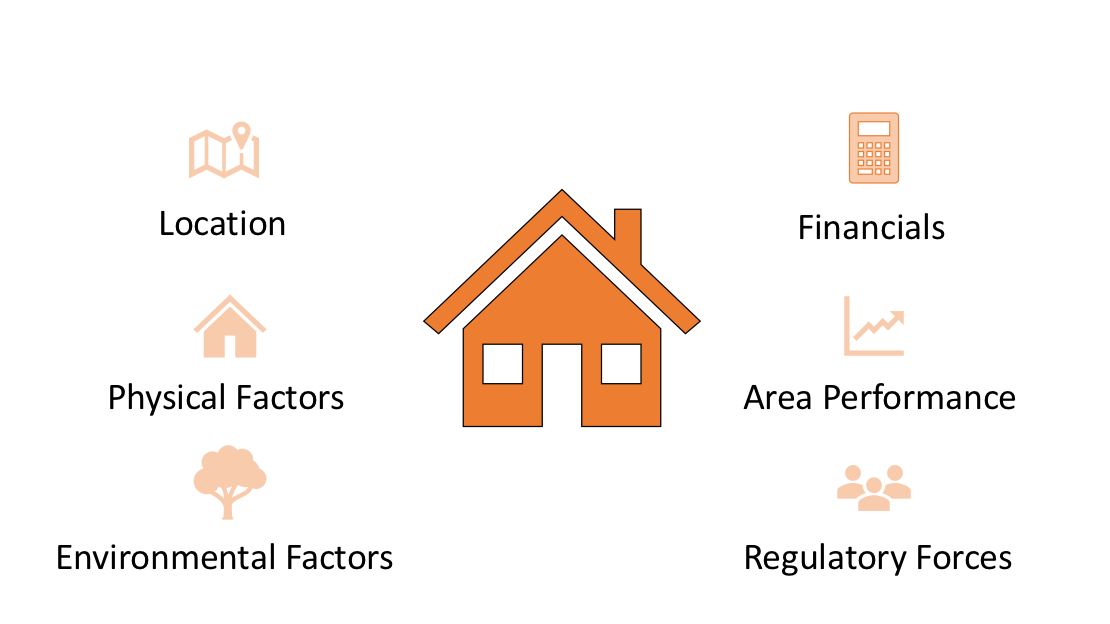

Proximity to amenities, green space, breathtaking views, and the area's standing aspect prominently right into home evaluations. Distance to markets, warehouses, transportation hubs, highways, and tax-exempt areas play a crucial role in business property evaluations. A crucial when thinking about residential property area is the mid-to-long-term view concerning how the location is anticipated to advance over the financial investment duration.

The Best Guide To Amur Capital Management Corporation

Thoroughly evaluate the ownership and designated use of the immediate areas where you plan to spend. One way to accumulate details about the prospects of the vicinity of the residential or commercial property you are thinking about is to speak to the community hall or great site various other public agencies accountable of zoning and metropolitan preparation.

This supplies normal revenue and long-lasting worth admiration. This is generally for quick, tiny to tool profitthe common property is under building and sold at an earnings on completion.

Report this page